Forbes article Why Logistics Technology Matters from December 1st, 2021 pointed out something that is so relevant and we believe will shape the next few years in the logistics and supply chain industries: “To compete in this new world order, businesses with core logistics must multiply their investments in logistics tech.” This competition has accelerated in the past two years of the pandemic, making way for a new industry sector, called LogTech, to emerge.

While the software companies of the world have set a name in the industry, thirty years ago, by building their own software code, this seems to be changing with the digital transformation, which makes every company a software company to some degree. Each company writing its own code for the software required to run its supply chains and logistics doesn’t seem to be the most efficient way to go about it in the world of APIs, thus setting the context for new companies to come in to fill up this gap.

We know that the investment in LogTech has been significantly increasing in the past years, which translated into innovative solutions solving a diverse range of problems that the logistics industry is facing. Alcott Global, Cambridge Capital & BGSA, The Journal of Commerce (JOC) & IHS Markit, Thetius, and REFASHIOND Ventures & The Worldwide Supply Chain Federation released a market map of technology innovations for the global supply chain and logistics market, which was released on November 23, 2021.

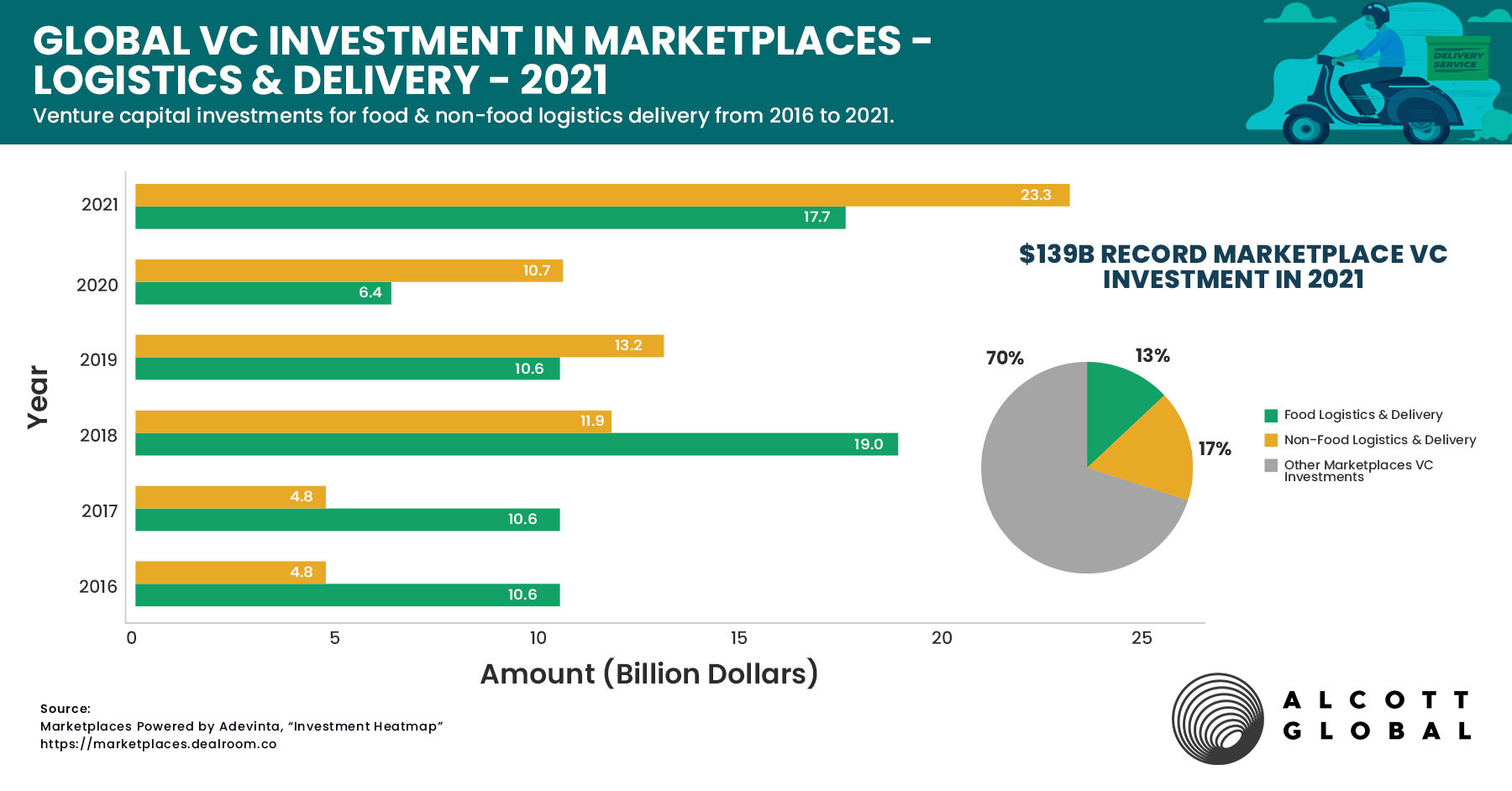

In this article, we intend to have a closer look at what happened in 2021 with the VC investments into the marketplaces, putting a magnifying glass over the progress of VC investments in the past five years into the Logistics & Delivery marketplaces. The data for this infographic is compiled by – Dealroom in their report issued in January 2022.

The combined enterprise value of marketplaces has seen a 36% growth in 2021 and is valued at $7.2 trillion at the end of 2021. In 2021, a record VC investment into marketplaces of $139 billion was raised globally and the logistics and deliveries marketplaces have gotten 30% of it.

This is a space to follow on how it will evolve over 2022 and we expect it to break the record from 2021. Based on the real-time heatmap by Dealroom, the logistics & delivery industry (food & non-food) marketplace has already raised 9.4B until mid-February 2022.

With this kind of investment, last year’s predictions that logistics tech will become larger than marketing tech in this decade seem not to be far-fetched and we are looking forward to the innovations that are coming with it!