The world has been irrevocably changed in the past two years and the supply chain, logistics, and transportation are still dealing with disruptions and uncertainty. Along with other disruptions, the change in consumption patterns enabled by e-commerce has been driving up demand for shipping containers and causing ships congestion in ports.

In the last three quarters of 2021, the overall TEU capacity on the three major routes Trans-Atlantic, Trans-Pacific, and Feast-Europe has seen an increase by 12%, which was insufficient and shipping containers were in high demand, keeping the container rates high. As per Sea-Intelligence press release on the 22nd of March 2022, the global shipping lines made an astounding operating profit of over U.S. dollar 110bn. “In short, the industry has tripled its operating profit in 2021-FY compared to the past decade. And this is discounting MSC (privately held) and PIL (irregular updates).”

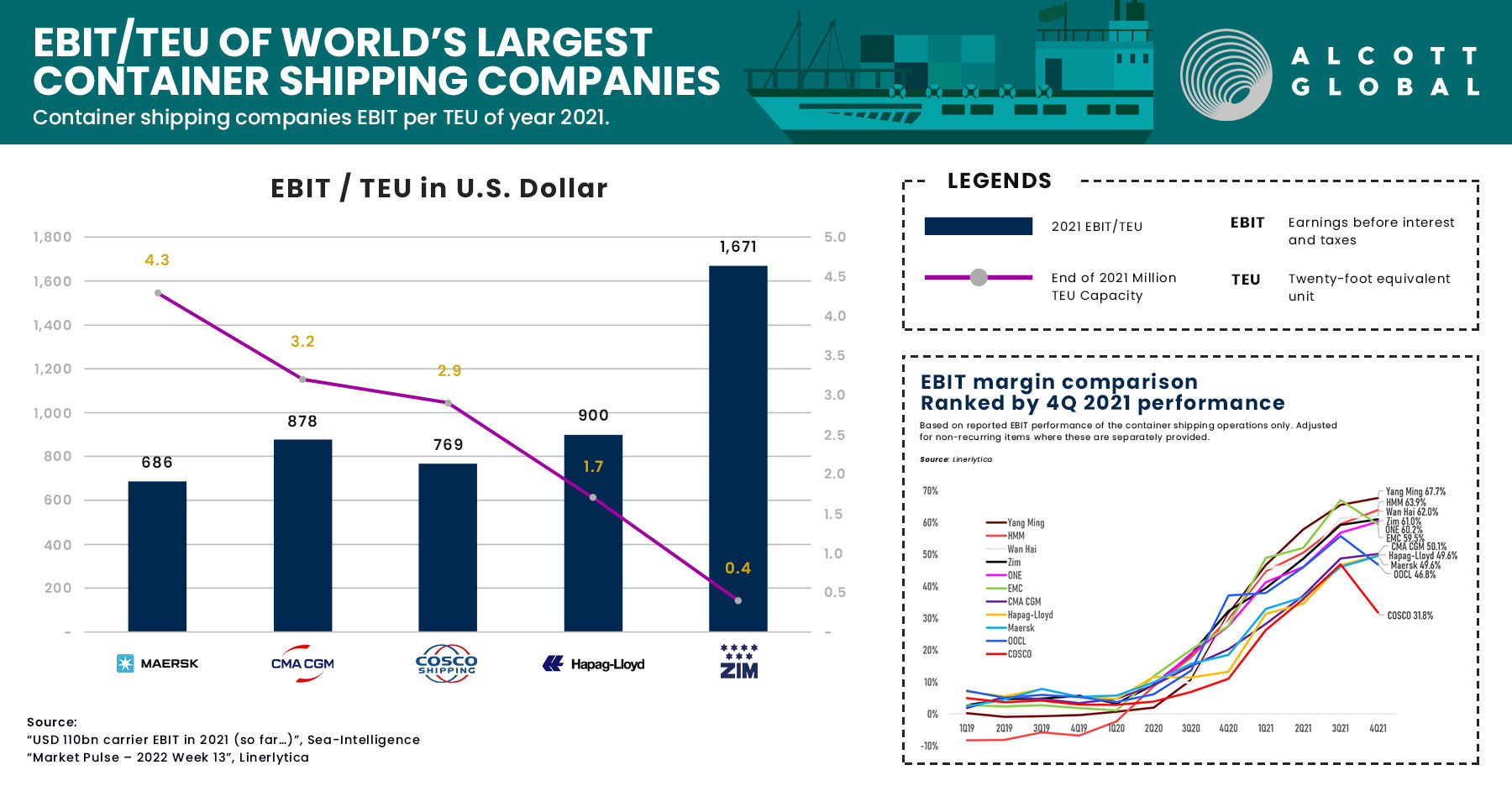

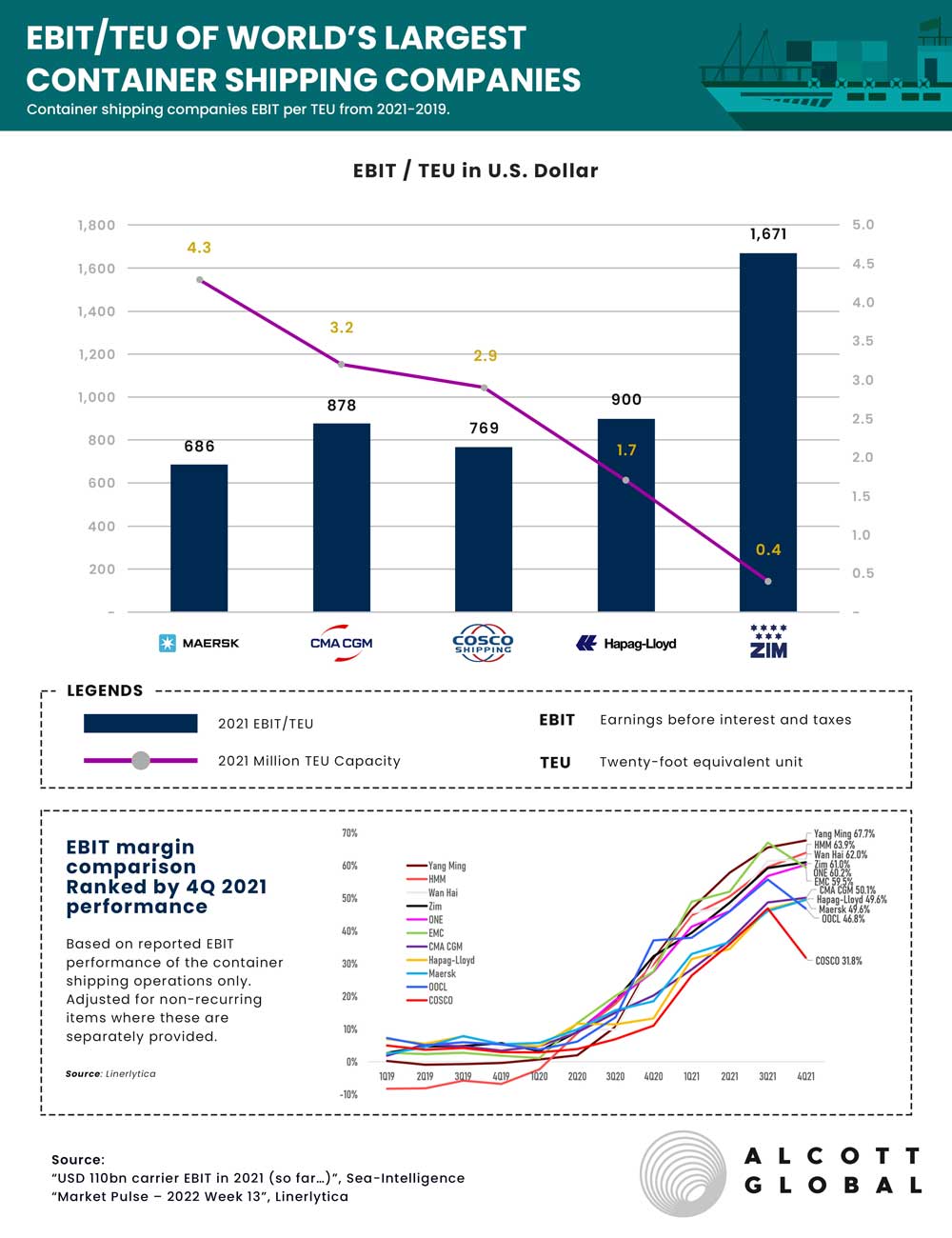

The top 10 largest shipping companies continued adding vessels and containers throughout 2021 increasing their fleet by 1.1 million TEU in the last nine months of 2021 and it is interesting to see the record profits distribution vs. the capacity transported. Maersk, with a 4.3 million TEU capacity, made, on average, an EBIT of over 686 U.S. dollars per TEU transported in 2021, up from 127 U.S. dollars per TEU transported in 2020. Israel-based ZIM reported the highest EBIT/TEU in 2021, amounting to almost 1671 U.S. dollars for TEU transported. ZIM’s fled totaled 0.4 million TEU capacity by the end of 2021.

Lynerlitica went on to publish, a detailed evolution by quarter, of EBIT/TEU trends for the top 10 shipping lines, from the first quarter of 2019 to the last quarter of 2021. While the trend is ascending between 19Q1 and 21Q3, in the last quarter of 2021, COSCO, OOCL, and EMC reported sharp declines in the operating margins for their container shipping operations. To explain this decline, Lynerlitica mentioned that “COSCO and OOCL, in particular, have taken significant provisions in the second half of 2021 and their improved cost base is expected to materially lift 2022 earnings.”

In 2022, container rates have been constantly decreasing, Drewry reported $7,874.43 per 40ft container on the 21st of April 2022, 24% down from the record high rates in October 2021. Does it mean that there is enough capacity on shipping lines or the demand has changed yet again? Will we continue to see descending trends on spot rates, or what we are seeing is a result of disruptions related to prolonged lockdowns in China?