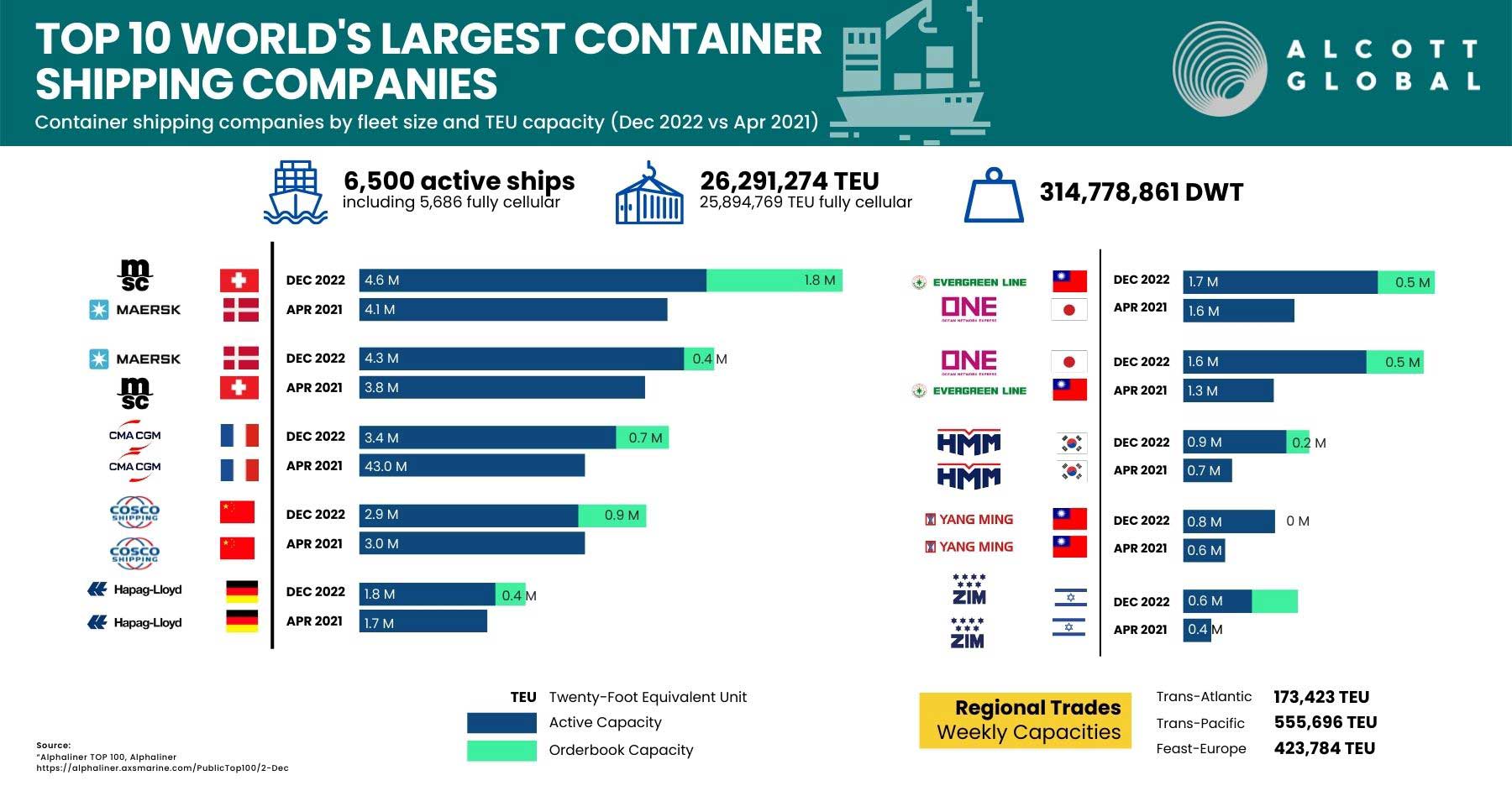

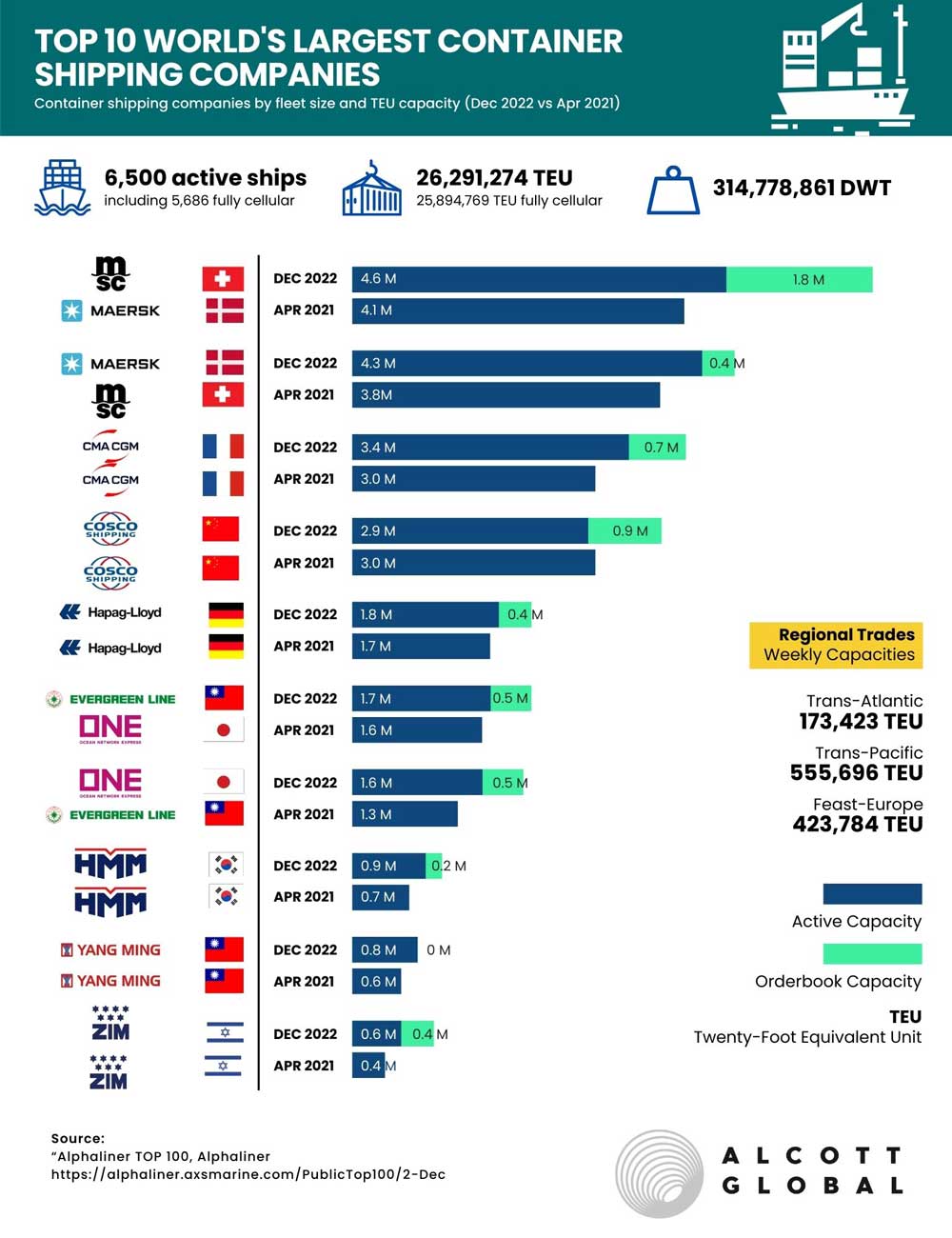

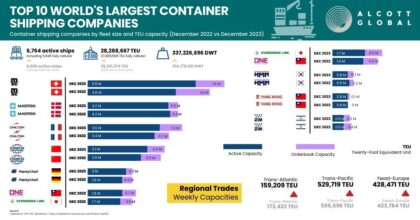

If you were wondering how much the capacity of the Top 10 shipping lines has increased since the beginning of the second quarter of 2021, when container rates were in ascension, the response is in this infographic.

Italian-Swiss international shipping line Mediterranean Shg Co has secured its first position with a current capacity of 4.6 M TEU / 709, and additional 1.8 M TEU / 31 ships in the orderbook overtaking A.P Moller-Maersk by 0.3 M TEU as of December 2, 2022. Since April 2021, MSC has increased its fleet by 21% and its order book capacity this month is the size of the entire fleet of the Top 5 Shipping Line – Hapag-Lloyd. With great earnings, from the pandemic years, MSC has expanded not only its shipping fleet but has entered the aviation business in September 2022.

All Top 10 Shipping Lines have each increased their capacity since April 2021, by 3-50%. Israel-headquartered ZIM, increased from 0.4 M TEU to 0.6 TEU, a 50% increase, while the overall Top 10 Shipping Lines capacity has increased by 12%, from 20.2 M TEU to 22.6 M TEU.

The overall orderbook for the Top 10 Shipping Lines, as of December 2, 2022, represents a 26% increase from their overall current capacity (December 2022). The orderbooks will be fulfilled well into 2023, and the new capacity will represent a 41% TEU increase as compared to April 2021.

Moreover, in the same article, the same expert has estimated that: “liner shipping will post a full-year net profit of $223.4bn, a 50.6% improvement over the record profits made last year” and that shipping “industry’s profits beat those at FANG, the acronym for Facebook, Amazon, Netflix and Google, favorites of the capital markets owing to their fast-growing profits.” (Link to the original LinkedIn article)

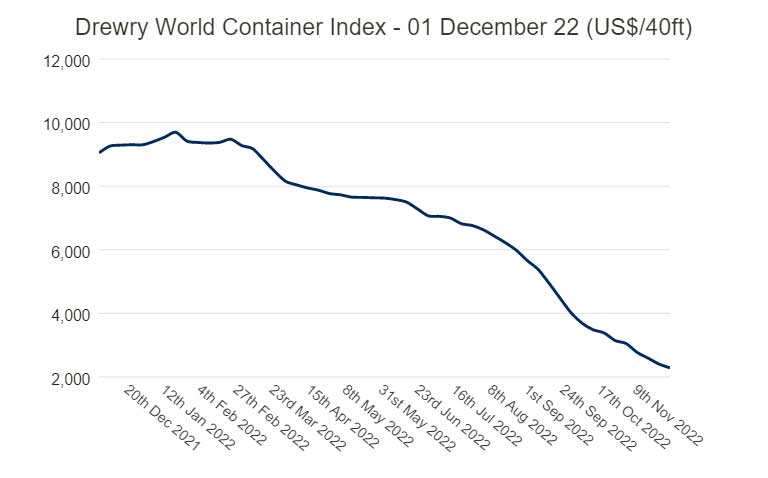

The shipping industry is continuously changing. The volumes in the 3rd quarter of 2022 are down by 3.9%, as compared to the 3rd quarter of 2021, and the weak demand, due to inflation, might be impacting the volumes somewhat, but for now it isn’t clear to what extent will profits be impacted. Furthermore, the new regulations related to sustainability, with strict limits on Carbon Intensity Indicator (CII), will see some changes in the fleet, as it is estimated that 95% of the vessels in service are using fossil fuels and might need to be replaced in by 2024-2025.