The maritime shipping sector was hit with setbacks in the first half of 2020, caused by the initial waves of coronavirus, which created a crisis in the supply chains around the globe and major disruption. Shipping volumes initially declined as factories in Asian production hubs were locked down, only to be overstretched when lockdowns were over, by significant restocking needs. Furthermore, the e-commerce boom has escalated into increasing demand, driving record-high new orders for container vessels. In the last three quarters of 2021, the overall TEU capacity on the three major routes Trans-Atlantic, Trans-Pacific, and Feast-Europe has seen an increase of 12%.

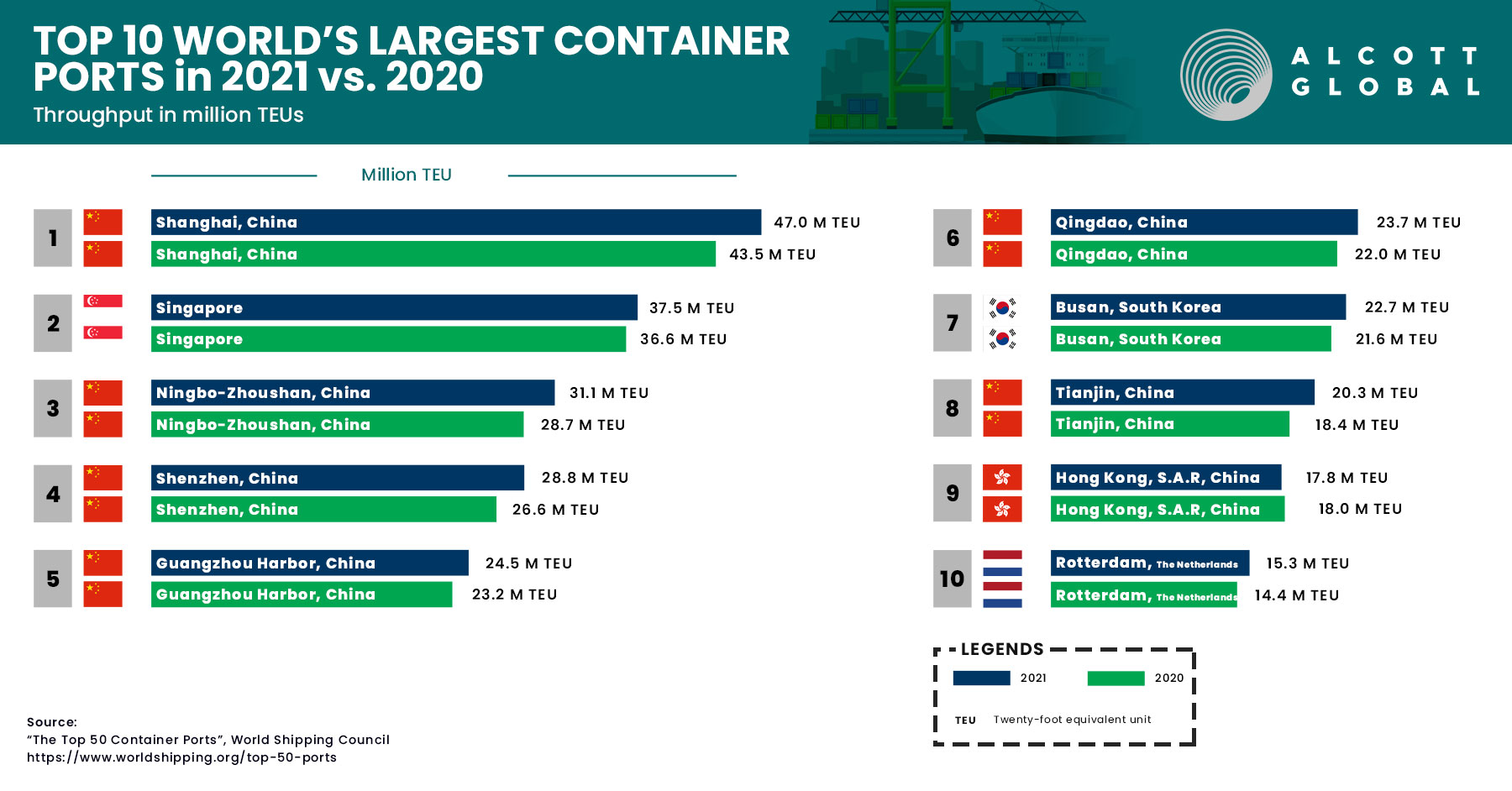

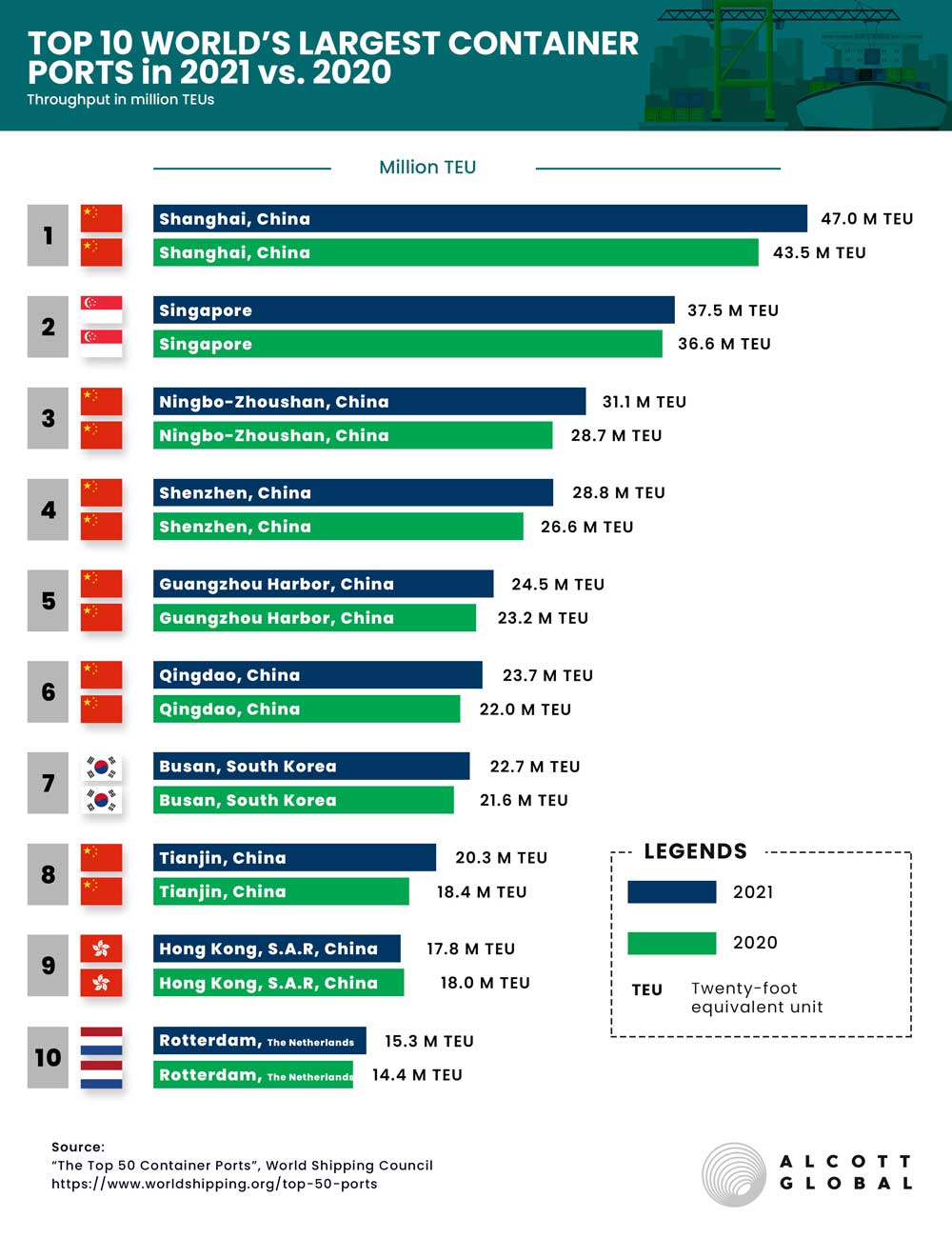

There is no difference in the 2021 rankings as compared to the Top 10 Largest Ports of 2020, except for the capacity handled, which increased by 5% in 2021. We can observe that the ports in Asia, especially in China, have increasingly dominating the industry in the past years. In addition to several Chinese ports, Singapore and Busan in South Korea also make the top 10 ranking, while in Malaysia, Taiwan, and Thailand, completely new shipping hubs have emerged.

In 2021, the top 10 shipping hubs have handled double the capacity as compared to the capacity handled by the top 10 shipping hubs in 2005, as shown in a chart by Statista.

2022 brought back China to complete a full circle, 2 years after the months-long lockdown at the beginning of the pandemic, with a 2 months-long lockdown due to the omicron variant of the coronavirus. “To ease congestion around Shanghai, sailings are being diverted to Ningbo and Taicang, according to Donny Yang, Dimerco’s director of ocean freight.”

Will China continue to dominate the maritime sector, despite the lockdowns and the active projects toward regionalization of the supply chains, in 2022?